About Us

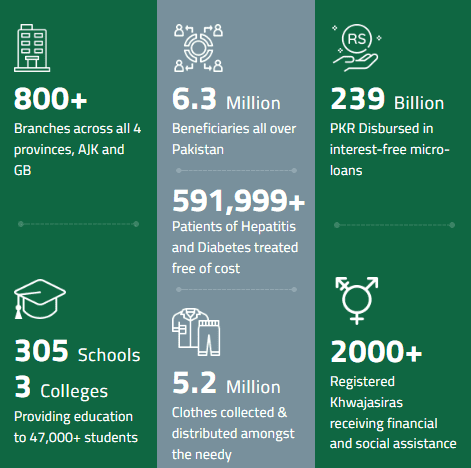

Since 2001, Akhuwat has been working for Poverty Alleviation

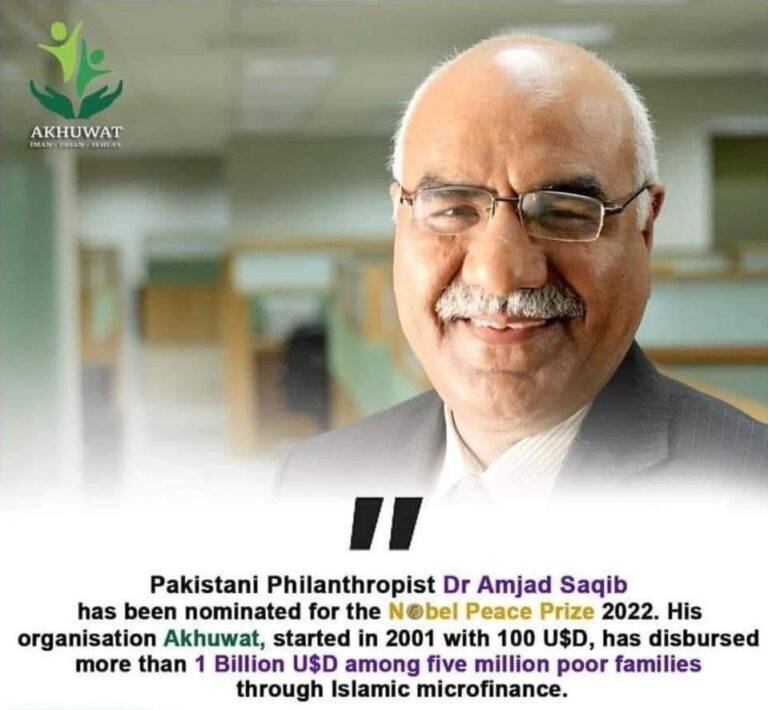

Akhuwat is a not-for-profit organization which was founded in 2001 on the Islamic principle of Mawakhat or solidarity. The concept of Mawakhat predates to 622 CE when Prophet Muhammad (Peace Be Upon Him) urged the residents of Medina (Ansars) to share half of their belongings with the Muhajirs (migrants) who were forced to flee persecution and migrated from Mecca to Medina. Drawing inspiration from the generosity displayed by the Ansars, Akhuwat believes that if the same approach, where one affluent family embraces a less fortunate one is adopted today, inequality will be eradicated from the world. read more

Projects and Programs

Use full Links

- Board Of Director

- Branch Network

- Akhuwat Progress Report

- Impact Assessment Reports

- Loan Process

- Loan Products Offered

- Testimonials

اخوت فاؤنڈیشن بلاسود قرض

اخوت فاؤنڈیشن کے ساتھ اخوت لون 2025 آسان ہے! چاہے آپ کو گھر، کاروبار، تعلیم یا شادی کے لیے قرض کی ضرورت ہو، ہم مدد کے لیے حاضر ہیں۔ ہم یقینی بنائیں گے کہ قرض کا عمل آپ کے لیے آسان اور ہموار ہے۔ ہماری ٹیم ہمیشہ آپ کی مدد کے لیے تیار ہے تاکہ آپ بغیر کسی مسئلے کے اپنا قرض حاصل کر سکیں۔ ہم اس بات کو یقینی بنانا چاہتے ہیں کہ قرض آپ تک محفوظ طریقے سے پہنچ جائے۔

Akhuwat Foundation’s new loan for 2025 has started, and you can right away! This plan follows Islamic principles, and people from all over daily. If you’re unsure how to use it, just reach out to our Akhuwat WhatsApp support team—they’re here to guide you step-by-step!

Get an Akhuwat Loan: Easy, Interest-Free Support for You

Akhuwat Loan is here to help people by giving interest-free loans to those who need money to start a business, buy a car, or support their family. We want to make life easier for those who don’t have a lot of money, helping them grow and reach their dreams.

Why Pick Akhuwat Loan?

At Akhuwat Loan, you can borrow money without any extra fees or charges. Our mission is to support small business owners, students, and families in getting the funds they need to succeed.

Types of Akhuwat Loans

- Business Loans: Start or expand your small business.

- Education Loans: Get money for school or college.

- Health Loans: Help with medical expenses or emergencies.

- Family Loans: Support for important family needs.

- Housing Loans: Build, fix, or improve your home.

- Agriculture Loans: Help farmers buy seeds, tools, or animals.

- Marriage Loans: Support for wedding expenses.

Akhuwat Loan: Interest-Free Support for a Better Life

The Akhuwat Foundation Loan Scheme is a program that gives interest-free loans to those in need across Pakistan, helping them grow their businesses and improve their lives. With simple and fair terms, Akhuwat makes it easier for people who are struggling financially to get the help they need to achieve their goals.

People have used these loans to successfully run their own businesses. But Akhuwat loans aren’t just for business—you can also get loans for school, health, housing, or even building a new home. Akhuwat believes in unity and equality, making sure everyone has a chance to succeed.

AKHUWAT

EDUCATION SERVICES

No society can prosper unless the fundamental right to education is granted

to all of its citizens. Therefore, Akhuwat’s vision of creating a poverty-free society would

remain incomplete unless the root cause; illiteracy, was addressed.

Continue Reading

Useful Links

- Akhuwat Collehe for Women Chakwal

- VJV School

- Akhuwat FIRST

- Akhuwat College Kasur

Welcome to the Akhuwat Foundation 2025

In 2025 you can Akhuwat Loan , Akhuwat Foundation will continue to provide interest-free loans ranging from PKR 50,000 to PKR 5,000,000. This program, inspired by Islamic values, is here to help those in need start or grow their businesses, pay for school, manage household costs, and cover wedding expenses.

Akhuwat’s goal is to promote kindness and community support, empowering people to become financially independent. Take a step towards building a brighter future!

Since it began in 2004, the Akhuwat Foundation has brought hope to many people in Pakistan. This non-profit organization offers a fresh take on banking by helping those in need without charging interest. Inspired by the Islamic idea of mawakhat (مواخات), or brotherhood, Akhuwat provides interest-free loans to help people start businesses, pay for education, or handle urgent expenses.

Akhuwat does more than lend money—it focuses on kindness and building community strength, helping people break free from the cycle of debt. With the right support, Akhuwat empowers people to lift themselves out of poverty and become self-sufficient. Across Pakistan, the Akhuwat Foundation is recognized and praised for its efforts to reduce poverty and uplift communities.

AKHUWAT

CLOTHES BANL

Useful Links

- Contact US

- Progress Report

Akhuwat Clothes Bank collects, sorts and cleans donated clothing & gifts and presents them to low-income families. These gifts are disbursed throughout the year

while special campaigns are carried out during peak winter season and natural disasters.

Continue Reading

AKHUWAT KHWAJASIRA

SUPPORT PROGRAM

Useful Links

- Linkages Established

- How can you help?

- Contact

Easily Check Your Akhuwat Loan Status Online

Dear valued customers, Akhuwat now offers the convenience of applying for your loan online! To review your loan status, just enter your valid CNIC and the official file number provided by the Akhuwat Loan Department.

If you experience any issues with the online loan status check, please reach out to our Akhuwat WhatsApp Helpline for assistance. We’re here to help!

How to Check Your Akhuwat Loan Status Online?

If you have taken a loan from Akhuwat, there’s now an easy way to track your payments! Akhuwat Foundation recently added a feature on their official website that lets you check how many installments you’ve paid and how much you still owe.

To view your loan status, simply enter your ID card number and file number or mobile number on the website. This self-checking system was created to help customers easily monitor their loans.

Visit the Akhuwat Foundation’s official website anytime to stay updated on your loan details. We hope this helpful feature makes managing your loan easier!

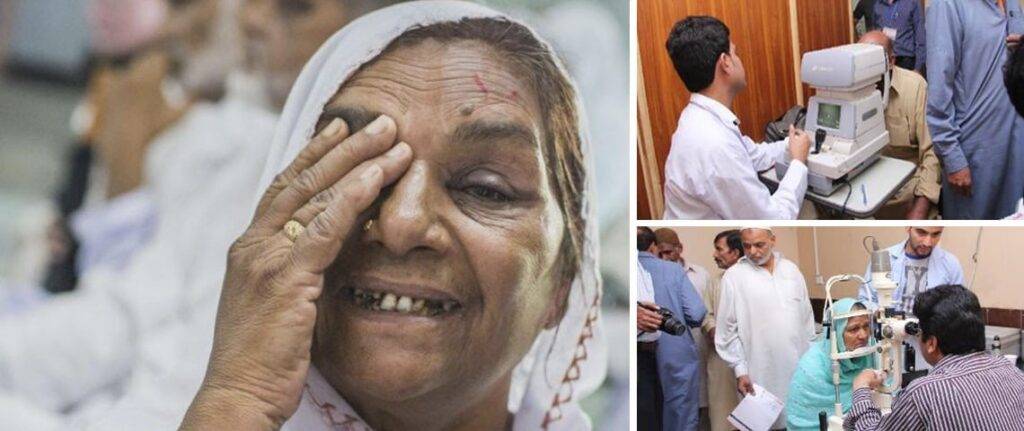

AKHUWAT

HEALTH SERVICES

Useful Links

- Contact US

- Progress Report

Loan Payment Plan

| Loan Amount | Time Period | Monthly Installment |

|---|---|---|

| 50,000 | 01 YEAR | 4,170 EMI |

| 100,000 | 01 YEAR | 8,335 EMI |

| 500,000 | 05 YEARS | 8,335 EMI |

| 1,000,000 | 10 YEARS | 8,335 EMI |

| 1,500,000 | 10 YEARS | 12,500 EMI |

| 2,000,000 | 10 YEARS | 16,670 EMI |

| 3,000,000 | 10 YEARS | 25,000 EMI |

| 5,000,000 | 15 YEARS | 27,780 EMI |

Akhuwat Loan Process

Eligibility Criteria for Loans

Following general points are compulsory for eligibility of loan:

Applicant should have valid CNIC.

Having the ability to run / initiate business activity having age between 18-62 years.

Applicant should be economically active.

Applicant should not be convicted of any criminal offence in lieu of which proceeding are in progress.

Applicant should have good social and moral character in his community.

Applicant should have capacity to provide two guarantors other than family members.

Applicant should be resident of operational area of branch office which might be around 2-2.5 KM radius.

Note: – Project specific eligibility criteria may be varied.

Lending Methodology

AIM’s lending policy involves disbursement of interest free or Qard-e-Hasan loans through Group Lending

Individual Lending

However, decision of lending methodology depends upon the loan product as well as project specific requirements.

Group Lending

Group Lending includes disbursement of Qard-e-Hasan loans among groups of men and women who are looking forward to enhance their family income but are unable to do so due to scarce resources. In group lending methodology groups of 3 to 6 members will be formed, all group members would guarantee loans and credentials of each other. Group Lending enables group members to resolve their social and economic problems through mutual understanding and decision making.Before applying for a loan, applicant is supposed to constitute a group of 3 to 6 members residing nearby to each other and members shouldn’t be close relatives to each other.

Individual Lending

Individual Lending includes disbursement of Qard-e-Hasan loans among individuals. Loans are offered to certain individuals that fulfill the eligibility criteria of scheme in order to facilitate them to meet their needs through interest free loans. In case of individual lending two guarantors will be provided by applicant for availing interest free loan.

Application Submission

The loan process will start with the submission of application. The application fee may vary from scheme to scheme. The unit manager will then evaluate the application through eligibility criteria. Thus, these loans will be given out on social collateral. The following steps will be followed in application submission.

Applicant will visit nearest AIM branch along with his/her relevant documents (mentioned below) for submission of loan application.

Unit manager will discuss with the applicant to check whether applicant falls under eligibility criteria of the scheme.

Potential candidate will submit loan application on prescribed form. Loan application will be provided and filled by AIM staff in branch office.

Unit manager will check documents and application will be processed after completion of required documents.

The following are the details of collaterals that may be applied for loans:

1. Personal responsibility

2. Two guarantors

3. Postdated cheques

4. Any additional collateral in special case.

Following documents shall be submitted along with loan application:

Copies Of CNIC

Applicant (Mandatory)

Guarantors (Mandatory)

Family Member (Optional)

Objective

For Identification

For verification in Management Information System (MIS)

Bank Requirement for collecting money

Latest Utility Bills

Applicant (Mandatory)

Objective

For address verification

To assess Payment Behavior

Latest Photos

Applicant (Mandatory)

Objective

For identification

Copy of Nikahnama

Applicant (Mandatory) (may be waived if not available after verification by other means)

Objective

For identification in case CNIC of wife is not with the name of husband

Note: – Additional documents may be demanded according to scheme’s requirements.

Social Appraisal

Social appraisal aims to verify character and credibility of the applicant by visiting his residential place. After receiving the Application, unit manager performs social appraisal through following methods.

Information from existing borrowers

From the living style of the applicant

Views of neighbors about the applicant

Personal interview/ family interview

Business Appraisal

Through the scrutiny of business plans the business idea of the intended borrower will be evaluated to see if it is viable and whether it can generate income beyond the household expenses sufficient for loan repayment. Business requirement is evaluated in business appraisal. This will also help fine-tune the applicant’s business idea itself. The applicant’s family will also be interviewed to make sure that they know about the loan and support the business idea.

Second Appraisal:

After initial appraisal by the unit manager, the application will be forwarded to Branch Manager who will appraise the social and business appraisal process once again and conduct a meeting with borrower and their guarantors.

Fund Request & to head office

Once loans are approved by the LAC, the required amount of funds is requested to the Head Office through the Regional Manager. The head office makes necessary arrangements for transfer of funds.

Loan Disbursement

Disbursement takes place once a month and loans are distributed through an event usually held at a mosque or church. In case the individuals, lending applicant has to be accompanied by at least one guarantor. In case of group lending, all group members are to be present at the time of disbursement. Funds are transferred through Cash Over Counter (COC) facility, where beneficiary will visit the counter of concerned Bank and will receive the money. However, disbursement may also be made by direct transfer of money into respective bank account of beneficiary depending upon the nature of the project and amount of the loan. For disbursement purposes, any other verifiable mechanism may be adopted on the discretion of the AIM.

Simple Steps to for Akhuwat Loan

- Visit the Official Website: Go to the Apply button and fill the form.

- Find the Loan Check System: Look for the loan check system on the website.

- Enter Your Details: Enter your ID card number and mobile number to view your loan status.

- Press “Check Loan”: Click on the “Check Loan” button. Your Akhuwat loan details will appear, showing information such as how many installments you’ve paid, your remaining balance, the total loan amount, and the time left to complete the loan.

- View Your Details: You’ll also see your name and all the necessary information to help you track your loan easily.

Akhuwat’s loan check system is designed to be user-friendly, making it simple to stay updated on your loan status.

Akhuwat Foundation 2024 Loan Program: Accessible Support for All

The Akhuwat Foundation has introduced a new loan scheme that is beneficial for everyone, regardless of income level. Whether you’re in need or simply looking for support, this scheme is here to help. The application process is straightforward and doesn’t require extensive proof—just basic business information if you’re applying for larger amounts.

This scheme allows people to access loans of up to 50 lakhs with simple requirements. Thanks to these efforts, the Akhuwat Foundation has gained popularity across Pakistan. So, whether you run a small business or a large one, apply from anywhere in the country and take advantage of this opportunity!

Apply Up to Rs. 5 Lakh in One Day: Akhuwat Foundation Loan Update

The Akhuwat Foundation is proud to offer instant financial support for any need, providing collateral-free and interest-free loans of up to Rs. 5 lakh within just one day! With monthly installments starting at only Rs. 3,400, both men and women can apply from anywhere in Pakistan.

The latest update for 2024 allows individuals aged 18 and older to access a 100% interest-free loan. This opportunity is available in every city across the country, making it easy to secure an instant loan for your needs.

As the largest interest-free loan scheme in Pakistan, the Akhuwat Foundation invites everyone to apply without needing any guarantees or security. For complete details, simply reach out to our WhatsApp number, and get connected with your local Akhuwat Foundation office today!

Akhuwat Foundation: Easy Apply Online Loan for 2025

For any information about the Akhuwat Foundation, feel free to call our contact number at . We’ll connect you with the Akhuwat head office and provide all the information you need. Don’t hesitate to reach out quickly—we offer a variety of loans to meet your needs.

We all face financial challenges at times, but Akhuwat is here to help you achieve stability. With our personal loans, you can access customized financing without needing collateral, allowing you to pay in easy monthly installments.

- Loan Amounts: Starting from PKR 50,000 up to PKR 50,00,000

- Tenure: Ranging from 1 to 20 years

- No Security/Collateral Required

- Flexible Pricing Options: Choose from both fixed and variable pricing options.

Apply online now and take the first step toward financial freedom with Akhuwat!

How to Apply for Akhuwat Foundation Loan 2025

If you want to submit an application for the Akhuwat loan scheme in 2025, the first step is to visit the official Akhuwat Foundation website This website is a valuable resource where you can find all the latest updates and important information about the loan program.

Recently, the Akhuwat Foundation has announced a revival of its loan program, offering loans ranging from Rs 5 lakh to Rs 50 lakh. An important feature of this program is that loans of up to Rs 5 lakh will be provided without any interest charges, making it an accessible option for those in need.

Akhuwat Loan Limits: Understanding Your Financial Options

The Akhuwat Foundation offers loan amounts that range from Rs. 50,000 to Rs. 50,00,000. This initiative is designed to provide financial assistance to deserving individuals and families, ensuring that both the underprivileged and those in need can benefit from the support offered.

The program is flexible, allowing applicants to choose a repayment period that suits their needs. Whether you’re looking to start a business, fund education, or meet other financial needs, the Akhuwat Foundation aims to help you achieve your goals with its comprehensive loan options.

Akhuwat Foundation Loan Contact Number Lahore

To assist with all your needs, the Akhuwat Foundation has established its head office in Lahore, with additional offices located in various cities across Pakistan. The main head office in Lahore serves as the central hub for information regarding the Akhuwat Foundation. You can visit their official website to find the latest updates, news, loan schemes, and registration details easily. Staying connected to the website ensures you remain informed about all the resources and services offered by Akhuwat.

For any inquiries related to loans or the foundation itself, you can reach out to the Akhuwat Loan head office contact number. This official contact number allows you to communicate via WhatsApp or a regular phone call. Whenever you need assistance or information regarding the Akhuwat Foundation, don’t hesitate to dial the contact number of the head office for prompt support.

How to Apply for an Akhuwat Loan?

Applying for an interest-free loan from Akhuwat is a straightforward process that can help you get financial assistance quickly. Here’s a simple step-by-step guide to help you through the application:

- Choose Your Loan Type: Akhuwat offers a variety of loan options tailored to different needs, including business loans, education loans, and emergency loans.

- Prepare Your Documentation: Before applying, make sure you have the following documents ready:

- Your Pakistani National Identity Card (CNIC)

- Proof of income

- A profile of your business (if applicable)

- Any other necessary documentation

- Contact Akhuwat: If you have questions or need assistance, you can reach out to their helpline at for guidance. Their staff can help you with application forms and provide information on the process.

- Submit Your Loan Application: You can apply in person by visiting an Akhuwat branch or contact point. Bring your prepared documents and fill out the loan application form with the help of the staff.

- Receive Your Loan: Once your application is processed, you can receive your interest-free loan within hours.

Akhuwat Loan Helpline Number

To better assist our community, the Akhuwat Foundation has established an official helpline. If you have any questions or need information regarding the Akhuwat Qarz program, you can reach out to us at our official office number: This helpline is managed by the Akhuwat Foundation Headquarters in Lahore and is designed to help inform and support those interested in our loan services.

If you encounter any suspicious calls or messages regarding loan offers, please do not hesitate to contact our official number via call or WhatsApp. Always remember, never provide personal information or send money to anyone claiming to represent the Akhuwat Foundation without verifying their authenticity. Our official staff is here to assist you and ensure your safety.

Akhuwat Foundation Official Website

Welcome to the official website of the Akhuwat Foundation Loan, the one and only official site for the Akhuwat Company in Pakistan. Please ensure you only visit this website for accurate information regarding your loan details. You can also contact us directly at our official helpline number:

On the Akhuwat Foundation website, you will find our official email address for any inquiries related to loan approval or other questions. For additional support, our WhatsApp number is also available at

If you have any queries or need assistance, don’t hesitate to connect with us through email or WhatsApp. Our head office is located in Lahore, and we are here to help you navigate your loan application process.

Beware of Fake Ads for Akhuwat Loan Scheme on Social Media

Many people in Pakistan know about the Akhuwat Foundation and how it helps people with interest-free loans. Because of this, some bad people are trying to trick others. They are putting up ads on Facebook and other social media, pretending to be the Akhuwat Foundation and offering loans. They ask people to pay fees to get these loans.

The Akhuwat Foundation wants everyone to know about these scams. Please be careful and don’t get fooled by these tricks. If you want to get a loan, always visit the official Akhuwat Foundation website or call their help number for real information. Stay safe!

Testimonial

Client Feedback

Our clients value the seamless loan process at the Akhuwat Foundation, praising our supportive staff and flexible repayment options that make financial assistance accessible and stress-free.